Revenue Share

This page talks about how revenue from the protocol is shared amongst various parts of the DAO.

The MahaDAO ecosystem has various sources of revenue, which get collected at a single place and distributed across various parties.

All fees get accumulated to the FeeSplitter contract, which is deployed at 0xe7d23c2b3e9148c46cec796f018842ab72d5867f

Revenue comes from the following channels:

Uniswap / Curve Trading Fees: All LP tokens and NFT positions staked in one of the various MAHA gauges transfer the trading fees earned to the DAO. Trading fees earned from Uniswap V3 are 1% on every trade.

Opensea, NFT Marketplace Royalties: All NFT marketplaces charge a creator fee for every sale of NFTs that happens on the protocol. This creator fee is currently set at 5-10%.

MahaLend Fees: Users that borrow ARTH from the MahaLend protocol pay a borrowing interest in the form of ARTH. This interest is split between lenders and to the DAO.

ARTH Redemptions: Any time a user redeems ARTH for the underlying ETH from an active loan, a 0.5% redemption fee is charged in ARTH.

To get a deeper idea of the various sources of revenue, we have prepared a Dune dashboard that showcases this information.

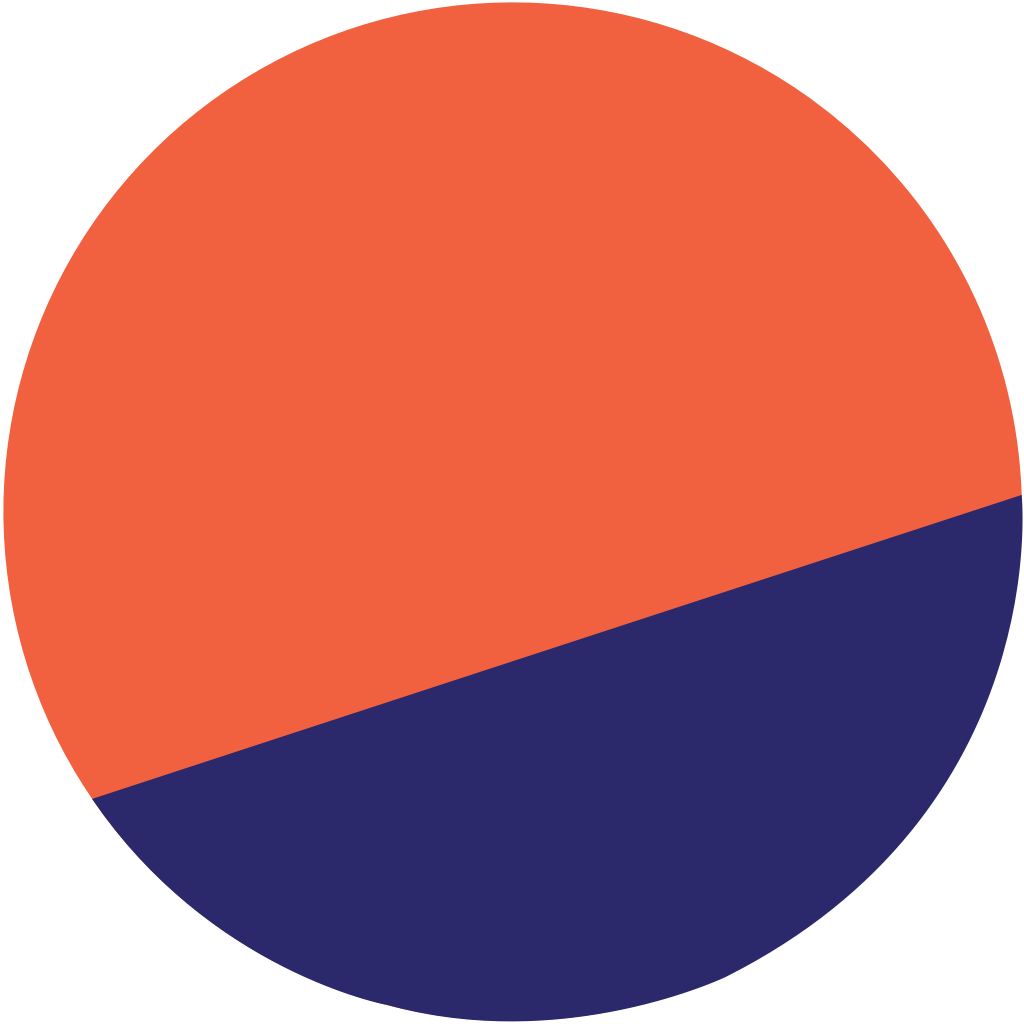

How Revenue Gets Distributed

Once revenue gets collected into the FeeSplitter contract, it then gets sent to various different sources to grow the protocol.

| Recipient | Allocation | Comments |

|---|---|---|

Liquidity Growth - Address | 10% | To continuously grow the liquidity of the ecosystem. See "Automated Liquidity". |

Core Team Operations - Address | 60% | Mainly to pay for operational expenses of the core team. |

ARTH v1 Holders - Address | 30% | To repay holders of the ARTH v1 protocol. See MIP.C2-0019 |

Changes to this distribution can be made via governance vote.

Last updated